Highest Loan To Value Purchase Mortgages And Remortgages - Low Rate Loans From £5,000 To £150,000 - Release Your Equity With An Equity Release Plan

It often helps to discuss this major decision with an experienced mortgage adviser. Feel free to call us on 0333 003 1505 (mobile friendly) or 0800 298 3000 (freephone) to speak to one of our UK based friendly mortgage advice team alternativelyEnquire Online and we will call you. Our customers have already obtained over £1 billion pounds & fixed mortgages are a specialty of ours - plus we will be more than happy to help you with any questions you might have on fixed rate versus variable rate mortgages. With our 25 years of experience, there are very few companies around that can level that much longevity into helping you.

What Is A Fixed Rate Mortgage?

With a fixed rate mortgage, the interest rates stays the same for a pre-determined set period of time. Basically, what this means is that for every month of the allocated time period, the mortgage payment due will always remain the same.

Fixed rates are only for an initial time frame that can be from 2-10 years but generally products offer 2, 3 and 5 year fixed deals most commonly. After the fixed aspect of your mortgage term is up, the mortgage interest rate will revert to the SVR (standard variable rate).

Fixed rates are only for an initial time frame that can be from 2-10 years but generally products offer 2, 3 and 5 year fixed deals most commonly. After the fixed aspect of your mortgage term is up, the mortgage interest rate will revert to the SVR (standard variable rate).Each time you are looking to secure a mortgage you will be faced with the question of which mortgage type you would prefer, even if you are just securing a second mortgage for a holiday home. That is why it is essential to get the right advice when making such an important financial decision. Read on to find out more about how a fixed rate mortgage works and the many pros and cons to this kind of mortgage type. Alternatively you can call us on the above numbers and our expert advisors will help find the right mortgage for your circumstance.

How Does A Fixed Rate Mortgage Work?

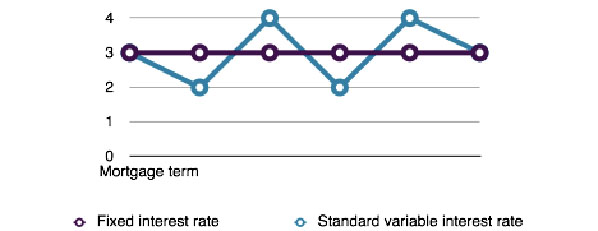

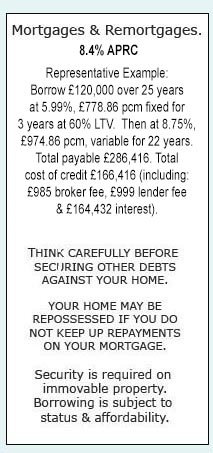

As you can see from the graph during the fixed rate period your payment will remain the same, regardless of what variable mortgage interest rates do. While you will end up paying less if rates go up, for example, the Bank of England base rate is increased. You will end up be paying over the odds of other interest rates, if interest rates fall during the fixed rate period.In most cases fixed rate mortgages normally carry an Early Repayment Charge if you want to remortgage or repay your mortgage off during the initial fixed rate period. With certain fixed rate mortgage products you are allowed to overpay each month, typically around 10% each year. To discuss specific costs and benefits of different fixed rate mortgages and what might be available to you then fill in our online application form and one of our advisors will get back to you with available quotes and options.

Advantages With A Fixed Rate Mortgage

Lets have a look at some of the key advantages for a fixed rate mortgage:- For a set period of time you will know exactly what you mortgage payment is going to be.

- Your payments won`t increase. Even if interest rates go up everywhere else

- As your mortgage is often your biggest financial outgoing, knowing what you need to pay allows you to allocate the rest of your money more efficiently. Perfect for budgeting

Disadvantages With Fixed Rate Mortgages

As with anything in life you must consider the disadvantages. Here are a few reasons that may result in you wanting to opt for a more flexible mortgage type:- If interest rates drop you will still have to pay the higher rate. You could end up paying more than the prevailing rate

- If you come into some money and want to repay your mortgage earlier you might be faced with ERCs (early repayment charges)

- The better fixed rates available often command higher arrangement fees

- If you do not re-fix at the end of your fixed rate period your rate will revert to the SVR which could result in a drastic increase to your mortgage payments

THINK CAREFULLY BEFORE SECURING OTHER DEBTS AGAINST YOUR HOME. |

Late repayment can cause you serious money problems. For help, go to moneyhelper.org.uk

Established In 1988. Company Registration Number 2316399. Authorised & Regulated By The Financial Conduct Authority (FCA). Firm Reference Number 302981. Mortgages & Homeowner Secured Loans Are Secured On Your Home. We Advice Upon & Arrange Mortgages & Loans. We Are Not A Lender.

First Choice Finance is a trading style of First Choice Funding Limited of 54, Wybersley Road, High Lane, Stockport, SK6 8HB. Copyright protected.

Every Quote Is Free & Confidential

Every Quote Is Free & Confidential